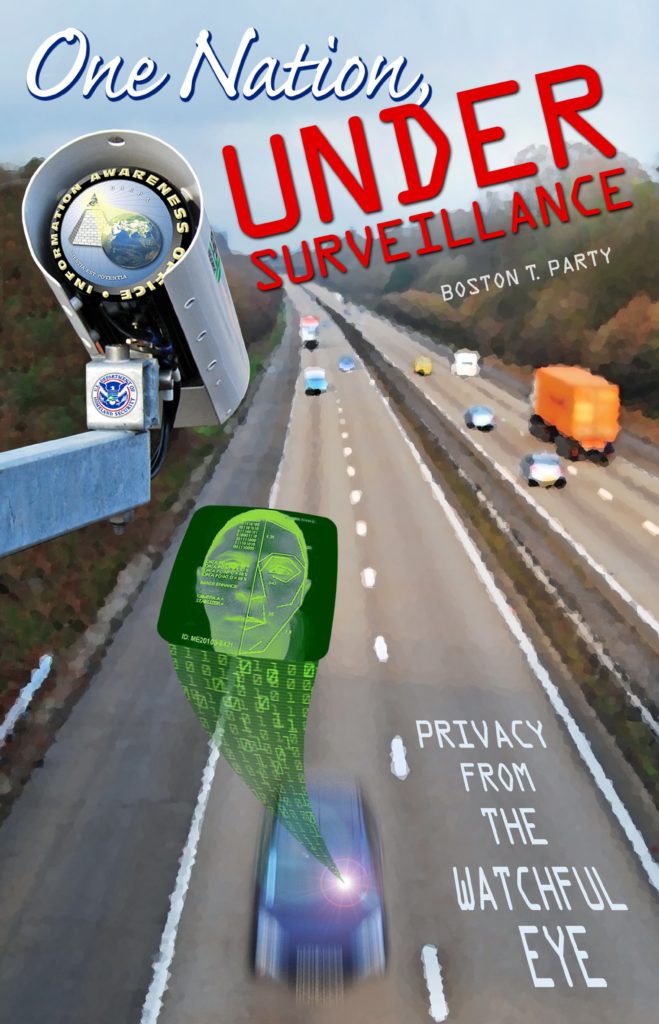

Book Review by Terence Gillespie

“Privacy is an insurance policy against oppression. Privacy allows a tyrannized citizenry to think independently, freely and clearly.”

– Boston T. Party

Such is the clear and historical perspective of Boston’s new privacy book, One Nation, Under Surveillance — Privacy From the Watchful Eye. In this most up-to-date and comprehensive book on the subject the author accomplishes three feats for those of us interested in state-of-the-art privacy:

- A complete analysis of why privacy is more crucial than ever, still possible and still works!

- A detailed description of who and what to protect our privacy against.

- An exhaustive and up-to-date implementation guide for achieving our own “sweet spot” of insulation.

In fact, Boston intentionally overdid his own privacy to learn how far it can be taken before it begins to work against you. This makes him one of the few Americans that can give first hand knowledge of the true costs, details and tradeoffs to balance in putting together our own plan.

Those familiar with the subject know that privacy cascades into multiple areas and down many rabbit trails of implementation. Because of its completeness and the inclusion of the three elements above it’s quite possible to implement a complete privacy plan using only this 480-page book as a companion.

More Crucial Than Ever (And Still Works!)

“Too many wrongly characterize the debate as ‘security versus privacy.’ The real choice is liberty versus control. . . . . that’s why we should champion privacy even when we have nothing to hide.”

– Bruce Schneier, “The Eternal Value of Privacy”

If you thought the battle for privacy was over after watching “Enemy of the State” Boston would ask why everyone still wants your data with every transaction or activity. The authors’ short answer to that question is that privacy still works!

If you’ve got black helicopters over your shoulder your cover is blown. However, using the same movie reference how much more peaceful would our lives be if everyone had 80% of the cover of Gene Hackman’s character?

The author would advise not turning yourself into a paranoid hermit obsessed to the point of having no life to protect. His suggestion is to commit to 20% of the full effort to achieve 80% of the results. In the authors’ experience going for 100% privacy consumes too much time, joy and money diminishing the quality of the life you’re protecting.

Keeping Your Nose Clean is Not a Plan

‘Doing nothing wrong and keeping your nose clean’ is normal rational behavior; it is not a privacy plan.

Viewed as a ‘privacy plan’ here’s the hard truth about ‘keeping your nose clean’: It might have worked in 1910, it was naive 30 years ago and it’s hazardous to your health, wealth and peace of mind, today.

As Boston describes, “What we are facing is, in effect, an environmental issue regarding tyranny’s pervasiveness. It’s as though the toxic gas of oppression is everywhere.” Going on to say “I may be wrong, but I don’t think that this force can any longer be fought and won on a national scale. Any inroads made there will evaporate after the next disaster or emergency or attack.”

The Data Beast

For an inside look at how hungry our state rats are over ‘public’ data aggregation see Catherine Austin-Fitts’ six-part series, The Data Beast. It’s a rare inside perspective on how important your live data is to those who pretend they already have it.

In benevolent hands accurate data is the beginning of discovery and optimizing the delivery of value. In evil hands it’s the most crucial element for manipulating the truth.

The State is selling an agenda not discovering a truth. The agenda is decided prior to data collection. Information that doesn’t support the agenda, although coveted within the agency, is squashed or denied publicly.

Climategate, Pandemics, the unemployment rate, the HUD scandal, the inflation rate, etc. . . . . The official story has nothing to do with the truth.

Beware of hungry data beasts masquerading as public servants.

The Cops and the Mail

Why does the average law-abiding heart race when seeing a cop or receiving a piece of mail from the state? Gee whiz, if you’ve done nothing wrong and have nothing to hide, then . . . blah, blah, blah.

Perhaps because the last guy “protected and served” owes $1500 or was “served” into the emergency room. Or, maybe you’re still paying the fine or tax levied on ‘no services rendered’ or violating some conjured up prohibition. If your news hasn’t covered such unpleasantries Will Grigg has expertly chronicled the increasing steady stream of such incidents. It’s especially alarming that police brutality is on the rise at a time when the police are in less danger of being killed in the line of duty than ever before.

The architects of our depression are hungry to fund their next crisis. With a broad legislative brush anyone can be painted guilty of something or other. This creates the target rich environment necessary for profitable selective enforcement.

I’m a generation behind the boomers, but, you guys better watch out: Your upcoming social security and medicare costs are a big liability to a hungry, broke and desperate state wolf. Maybe the timing of this universal health non-care ruse is no coincidence?

Let’s face it: We’re nervous when we see the cops or get state mail because these guys are either desperate for money or psychopaths that need to control us as part of their therapy.

Getting Back to Normal

Most of the modern day battle for privacy involves reclaiming information that, not long ago, could not be tracked or didn’t even exist!

In 1910 there was no:

- Social Security number to give

- Business income to track

- Income taxes to pay

- Phone number to hide

- Credit card to track activity

- Computer, Database, e-mail, internet

- Barcode to track shopping habits

- Gun registration

- DNA testing

And yet we had a higher quality of life than the world had ever seen.

We need to shed this notion that personal information is the price of better service. We’re not being served by its disclosure. We’re being numbered, branded, looted, sheered, taxed and vaccinated into a stupor.

We’re living in an age of laws so numerous and incomprehensible that enforcement can be focused on anyone ripe enough to harvest. Selective enforcement is a matter of revenue generation per the mood or balance sheet of the tax feeding agency.

There’s no shame in getting back to normal private behavior. The only shame is in what we’ve already given up.

Know Thine Enemy

“As long as you do not mistake a sociopath for a person of character, your privacy is generally safe from those whom you rightfully consider your friends.”

– Boston T. Party

One of the unique aspects of Boston’s latest privacy book is his crystal clear description of the enemy: The Psychopathic (Or sociopathic1) 4% of the population and the organizations they’ve infested.

“A sociopath is somebody who, through a combination of heritable condition, genetic predisposition and upbringing, has no sense of interconnectedness (bonding) with living beings and thus no foundation for an active conscience (Like the 96% rest of us who do have one). Studies indicate that sociopathy involves an altered processing of emotional stimuli at the level of the cerebral cortex, and thus sociopaths simply cannot process emotional experience, such as love and caring.” Chapter 6, pg. 11.

The author provides an extensive list of character flaws and behaviors to enable recognition of the psychopaths among us. A abbreviated list for the purposes of this article would be:

- Grandiosity

- Shameless lies

- Unreliability

- Lack of empathy

- Flair for manipulation

- Scheme further ahead than moral people can anticipate

- Audio/video record their victims much more often than vice versa

- Make Plans for Justice Backfire

- See sudden adversity as a challenge; they thrive on it

- Always act behind the scenes, which is difficult to discern

- Masters of manipulation through compartmentalization

Recognition of psychopaths is difficult for normal people. We tend to project our own innate goodness onto strangers and find ways to forgive their endless transgressions until its too late. By the time we recognize them, or dare to call them out, they’ve either damaged us or teamed up.

(To improve your recognition skills you can see one under a self-imposed microscope in the documentary film,”I, Psychopath“).

Apparently, these mutants recognize one another and tend to team up to take control of powerful organizations. “Psychopaths have this dream that they would like to govern. ‘We want to be the government,’ they think, and this dream is realized from time to time in the human history and this is a gruesome time.”2

“In the case of work, a psychopath may feel envious of another’s position and prestige, but will not actually work to achieve that position. Instead he will brutally manipulate and exploit the work of others in order to achieve domination. Hare and Babiak describe this phenomenon in their book, Snakes in Suits: When Psychopaths Go to Work.”2

The enemy is most likely to present in one of five entities:

- Individuals who make their way into your personal life.

- Gangs, the leader of which is likely to be fully psychopathic (Ralphie, if not Tony in the Sopranos).

- Organizations who, despite their benevolent banner, have been infiltrated to the point that their internal controls are largely psychopathic (SEIU, Climate Change Orgs, in some cases local police).

- Individual members of the state exerting direct psychopathic influence on policy.

- Any combination of the above who exert psychopathic control of state apparatus through indirect means (Enter our beloved illuminati and their NWO).

To all of these entities we (Normal, productive, law-abiding and rational human beings) are just one thing: Supply.

Once you realize who the enemy is privacy takes on the same urgency as your desire to continue living a moral and rational life. Without insulation we are in a constant state of derailment with a severe lack of freedom in making optimal choices.

“A right-thinking man – with puppet strings attached – cannot be a right-doing man.” (ch. 22, pg 20)

Batten Down these Hatches

The following outline was gleaned from the index of ONUS and provides a glimpse into the scope of implementing a complete privacy plan.

These are the elements of life most likely to cause exposure. Each element represents a privacy ‘hatch‘ to be batoned down in its own way. One of the major feats of the book; each element is addressed to the point that the reader could close the exposure, themselves. That would be an impressive feat in any one area, let alone all ten.

It would be possible to break out the computer sections and present them as a complete book on privacy in that area. Luckily, the author grants himself no such reprieve and we get it all in one book.

- People

- Friends

- Family

- Spouse

- Children (Schooling)

- Relatives

- Business contacts

- You

- Your mouth

- Your plan

- Your passport

- Your SSN

- Drivers License

- Other ID’s

- Mail

- Business

- Personal

- Vehicle Registrations

- Sending

- Receiving

- Business

- Asset Protection Entities

- Car

- Boat

- House

- Business entities

- Contacts

- Employees

- Assets & Data

- Offices

- Income

- W2

- Corporate

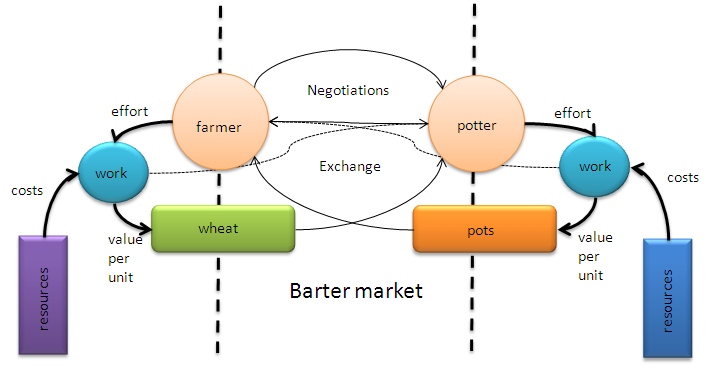

- Barter

- Insurance

- Communication

- Mouth

- Phone

- Cell

- VOIP

- Voice Mail / FAX

- Landlines

- E-mail

- Internet

- Social Networking

- Forums

- Blogs

- Web browsing

- Computer

- Windows (A surveillance virus masquerading as an OS?)

- MAC or Linux

- Data Backup

- Passphrases

- Physical Security

- Money

- Credit?

- Debit

- Cash

- Money Orders

- Digital Gold

- Gold & Silver Coins

- Checks

- Loans

- 401K / IRA

- Guns

- Private Sales only

- Minimal onsite

- The Purchase

- Ownership

- Selling

- Tracking

- Storing

- House

- Address

- Utilities

- Census

- Travel

- Car

- Hotel

- Bus

- Air

- International

- Border Crossings

- Insurance

- Life

- Car

- House

- Health

- Business

A complete plan would combine the private version of the elements, above, with behaviors that minimize exposure during interaction with untrusted people or entities.

Many life areas can and should be trimmed down and the author offers frequent tips on doing so. For instance, friends or relatives who can’t be trusted probably don’t belong in your life. And, trimming down business entities, employees, vehicles and office space leaves much less work in eliminating exposure to prying eyes.

In fact, it’s not easy to tell where Boston’s own well-researched techniques and experience blend with his accumulated knowledge of privacy. Hence, one of the author’s points: “Much of wisdom is using the hindsight of others as your foresight. . . . there is not enough time to learn the lesson from purely your own mistakes . . .”.

For those with the foresight to use ONUS over the next several years it’s an exhaustive and up-to-date implementation guide for achieving your own “sweet spot” of insulation. Beyond that, the universal principles outlined will have to be combined with your own improvisations as the data noose inevitably tightens in years to come.

The private lives we all have a right to will require a fight to reclaim.

Privacy Premiums

“To govern oneself is a natural imperative, and all tyranny is the miscarriage of self government. The first requisite of freedom is to accept responsibility for the lack of it.”

– E.C. Riegel, 1949

The Rules

- Don’t draw attention to yourself

- Privacy is complicated – think it through

- Privacy is expensive – don’t be greedy

- Privacy is inconvenient – don’t be lazy

- Privacy is private – don’t be glib

- Be consistent – be thorough

- Work your story out in advance

- Privacy requires your alertness

You Are Your Data

To most entities you are known only by your data. There is no personal relationship. Change your data and you’ve changed your ‘relationship’. Another way of putting it is that what happens to your data happens to you. Since we’re not talking about friends why not make the data version of yourself unavailable for:

- Tracking and control

- Subpoenas for bogus civil suits

- Visits from stalkers

- False arrest arising from bureaucratic screwups

- Unlawful search and seizure

- Forfeiture of personal possessions to agencies who are broke

Opportunity in Crisis

A move to another location is an excellent opportunity to reclaim lost privacy. The number of people leaving/losing their houses and renting provides good cover. With this book you could start tackling the problem in a big way during the move. What a great time to make privacy a part of your new life.

Never Take Candy from a Psychopath

Bargains with the devil always come with an incentive package. Turn them down:

- Loans from strangers

- Tax deductions that blow your privacy

- Child tax deductions if you’ll just get baby a social security number (Fight this: No baby needs one. Even the boomers won’t get their booty)

- Free medical tests or ‘screenings’ as an excuse to get your DNA into a database (All babies born in a hospital are now subject to this outrage).

- 10% off if you’ll just sign up for our in-store credit card

The candy offers go on and on. You’ll recognize them when you see them. Walk away. Consider the forgone ‘service’, discount or deduction to be a small cost of freedom.

A Little Goes A Long Way

Don’t get overwhelmed. Make privacy an extension of a normal civilized life. Change your mindset from within and calmly privatize one piece of life at a time.

Just a few pieces create a working bubble:

- Keep business income discreet.

- Never take candy from a psychopath (See list, above).

- Pay with cash or prepaid debit card.

- Keep computer and online activities private (Extensive tips on this in the book).

- Keep phone activities secure (Extensive tips on this in the book).

Use the peace from this privacy to map out a plan for the rest.

“Privacy is like fire insurance; you can’t get it after you need it. You get it first, and then hope that it never becomes necessary. (ch. 2, pg. 2)

The ONUS is On Us

“We’re not what we believe. We’re what we’ll fight for.”

There’s going to be a scuffle or two when reclaiming lost privacy. And, there’s going to be cost and inconvenience in maintaining the insulation level you decide on. Slowly, but surely, however, the river of trivialities that derail life can be brought to a trickle.

Reading through the implementation part of the book it’s evident the author has become quite brilliant at improvising privacy solutions as new exposures present. I believe the most valuable contribution of the book is that it tends to impart such improvisational skills to the reader.

“Do not confront, but learn to mask yourself and circumvent.” (ch. 22, pg. 17)

My overall take on ONUS is that it’s so thorough, comprehensive and actionable on such a complex (And urgent) subject that it was a practical sacrificial effort to get it all current and in one book. Apparently, this parting gift of liberty is no accident as it’s the authors last “Boston T. Party” book.

It would be a shame not to have this privacy tool available now that it’s needed most. But, it is available. All the mistakes have been made, we know privacy is crucial and possible, we know what the enemy looks like and have a detailed roadmap to get to a safe place.

The only shame would be in not taking privacy and shelter from the psychopathic storm.

Try imagining a place where its always safe and warm

Come in she said I’ll give ya’ Shelter From The Storm, —B. Dylan

Privacy Reference

1Psychopath and Sociopath are rough synonyms with pychopath implying inherited traits and sociopath leaving open the environment as a main contributing factor in causing the same behavior. The author uses the word sociopath perhaps to expand recognition of the traits to be present in seemingly normal everyday encounters, as they certainly are. I chose to use psychopath because the three friends I asked were better able to identify the word with the behavior.

2Interview with Andrzej M. Łobaczewski, author of Political Ponerology: A science on the nature of evil adjusted for political purposes.

Copyright © 2014 by Terence Gillespie. Permission to reprint in whole or in part is gladly granted, provided full credit and a live link are given to McGillespie.com