The decimation of the middle class continues through 23% unemployment1 and the daily evaporation of net worth. Those who remain employed are running to stand still taking up the slack of former, less fortunate, co-workers. Mortgage holders above water are the exception and many are cashing in what’s left of their 401k to meet expenses. The word retirement is fading into the dreams of yesteryear and will be a mere web-search term for children born after 2000.

There is a moral, peaceful and non-violent way to be on the receiving end of this slow-motion artificial wealth transfer. One of the keys is to understand . . .

Why Asset Prices Collapse

“Asset prices collapse during periods of hyperinflation when priced in gold.”2

When first reading that I wondered, “If assets are desirable and the currency is worthless then why would their price go down?” The answer is that prices rise in fiat and fall in gold. Why would prices fall when measured in gold? Current news headlines provide some answers:

- Some assets were overpriced to begin with and are returning to normal.

- Unemployment leaves people with less to spend causing less demand.

- Those with income cut back, save more and buy less causing less demand.

- Current housing inventory and projected foreclosures could meet demand for three years of sales. That figure is closer to four months in an efficient market.

- Equites, when priced in gold, have lost enough real value to cause people to flee into safer investments.

- Retirement plans are being liquidated to meet monthly expenses

- Luxury items are being sold to meet monthly expenses.

If current trends continue #2, #3, #5, #6 and #7 will get worse. If the banksters checkmate themselves into an inflationary corner then they will get much worse.

Women, Computers and Volcker to the Rescue?

In the early 80’s America was rescued from runaway inflation by three things: A massive influx of women into the workforce, the personal computer and the temporarily sane monetary policy of Paul Volcker. Many women followed the pied piper of woman’s liberation but the piper’s agenda was to double the work-force tax base. The second rescue was the personal computer and the ensuing productivity boost it poured into the economy. From a monetary point of view the same amount of money was now circulating in an economy with more productive workers and twice as many of them. Once again, the American public and ingenious entrepreneurs saved the state from its incompetence. Mom is now gone from the house, working and replaced with daycare and using computers developed by private entrepreneurs. And yet, it’s Paul Volckers’ monetary policy that is purported to have rescued America.

Is there anything on the horizon that could rescue the economy, today, as women and computers did in the early 80’s? Cold fusion? Free energy from the sky? A quadrupling of workers or their productivity? I’m not sure. But, there are ways to rescue oneself and family in any circumstances if they are understood.

Inflation and What Else?

The US has done more to cause hyperinflation than any country that’s ever actually had it. And yet, the US continues to escape this well-earned fate. Instead, bubble after bubble is popped and the proceeds are put into the bags of the ones who create them. For those who care about macroeconomic measures the most reasonable short-term expectations are more of the same of the last decade:

- Informal Devaluation

- Stagflation

- Continued Decline

Great, but it’s a waste of time to dote on things one has no control of. Instead, why not bone up on the usual ways wealth is transferred under these circumstances? The “Collapse” that everyone is expecting is occurring in slow motion. However, since it’s easier to see the trades if we pretend it will happen overnight I’ll refer to what I think will happen over many years as the “Collapse”, below.

Wealth Transfer around Collapsing Asset Prices

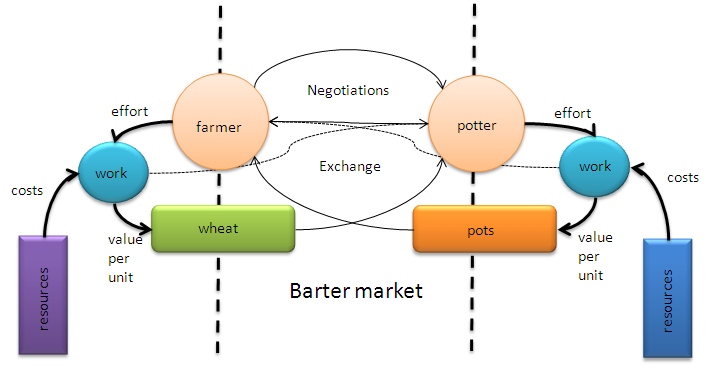

Vulture economics is wealth transfer from weak to strong, emotional to rational, unprepared to prepared, city dweller to farmer, productive to unproductive, Keynesian to Austrian, and from the manipulated to manipulator. In a crisis the unprepared and wealthy (In fiat only) will sell anything to meet basic needs. In Weimar, well-to-do city dwellers came out to the countryside to exchange cigars for meat, pianos for wheat flour and gold watches for potatos.3 In essence, they traded Diamonds for Water.

Prior to Collapse

In a trade of Diamonds for Water the guy with the water gets both and the guy with the diamonds gets some water before losing both.

The general pre-collapse roadmap is to:

- Think like a foreigner in your own country.

- Move towards employment and safety.

- Postpone the purchase (And sell excess) of future collapsing assets.

- Don’t payoff your house. Make the minimum payments on all mortgages and large fixed debts.

- Purchase real money and wealth storing assets.

- Stock up on the life essentials while they’re available and cheap.

- Invest in the factors of your own production.

- Warn who you can without causing resentment.

- Make a shopping list for the eye of the storm.

My Optimal choices are laid out in Your Optimal Bailout Plan, Depression Proof Your Money, Checklist for Hard Times and 240 Jobs That Won’t Disappear in an Economic Crisis. Essentially, you sell assets whose price will collapse (Further) and buy the staples of life while they’re available and cheap. Later you buy the “diamonds” by preserving the purchasing power of your savings and not relying on anyone to provide life essentials for your family. If hyperinflation occurs pay off your mortgage with an egg. If it doesn’t use silver and inflation to pay off your house.

Foreigner in Your Own Country

You hear it all the time: Those ‘foreigners’ come over here with suitcases and buy everything in sight because the Euro/Yen/Yuan/Franc is strong. The opposite used to be the norm: Americans traveling everywhere for $10 a day on world wide shopping sprees.

Gold is the best money in the world and enables easy conversion to every form of cash. If your idea of cash is limited to government issued fiat then at least hold a stable one. They’re all based on nothing but Swiss Francs and Canadian dollars will faire better than the dollar. See How To Buy Swiss Francs in 5 Minutes or Less.

Today, you can swap in and out of any currency in the world with the click of a button. There’s nothing to prevent swapping into the strongest fiat of the moment. It’s well known that during the currency crisis’ of Chile and Argentina the first people to exchange local fiat for US dollars were among the few to keep their savings from disappearing into smoke. Those who bought dollars prior to the official devaluations and newly issued local currency were saved. Soon it will be even more ironic that the widespread use of US dollars provided the stability needed for these countries to transition into a new fiat currency based on ten times the nothing of the first one that collapsed.

Or, you can “play it safe” and keep your “money” in the bank. You’ll be able to retain and spend every cent as it’s being devalued.

Field Trip

Take $500 to the bank and tell them you’re going on a trip to Switzerland and would like to purchase Swiss Francs. Take the Swiss Francs and put them in your pocket and let the feeling of having cash wash over you. If you ever need emergency cash convert them back and you’ll probably get more dollars than you started with.

Factors of Your Production

The best investment is in the factors of your own production: Health, education, training, building a strong network and community. If there’s no market for your specialty consider moving and/or directly producing what your family needs. Create a water rain catch system, grow your own food, make your on electricity, etc..

“Before you hunker down get out of the way”4

Many people are newly unemployed. Though beyond the scope of this article to explore would moving be a better use of your time than scanning the want ads? Would a move within the US, or to another country, be the best start of a new business or profession?

Wealth Storage

The TRJ/CRB is a benchmark representation of commodities as an asset class. These commodities are not the only place to store wealth but they do represent assets with well established markets.

- Aluminum

- Cocoa

- Coffee

- Copper

- Corn

- Cotton

- Crude Oil

- Gold

- Heating Oil

- Lean Hogs

- Live Cattle

- Natural Gas

- Nickel

- Orange Juice

- Silver

- Soybeans

- Sugar

- Unleaded Gas

- Wheat

Most of these have indexes for those who trust brokerage accounts. At least 10 of them, however, could be personally purchased and stored. Notice this list is in the Before Collapse section of the article.

Collapsing Assets

All of the following assets are collapsing and will continue to collapse relative to gold. Don’t be fooled by nominal price increases in fiat. Sell them now, if you can.

- The US Dollar

- Municipal Bonds

- US Treasuries

- High Multiple (P/E) Stocks

- Financial Stocks

- Equities in consumer discretionaries

- Grand Pianos

- Diamonds

- Luxury cars

- Yachts

- Jewelry

- Rental Houses

- Designer Watches

- Designer Handbags

- Recreational (Only) Property

- Luxury (Empty) Apartments

- Overpriced Wine

Signals to Look For

The Mainstream Media does not report real news so you’ll have to glean the timing of the worst part of the collapse from alternative media or inductive reasoning applied to personal observations. The short list would be:

- Witnessing a diamonds for water trade.

- A precipitous rise in gold or silver.

- Stock market collapse or close.

- Sharp increase in the rate of failing banks.

- Social unrest, heated protests or riots.

- Bank holiday followed by formal devaluation.

We had family members stay with us, last Christmas, from Venezuela. The week after they returned home Chavez devaluated the Bolivar by 40% for non-food and medicine imports causing panicked shoppers to flood the stores to beat overnight price increases. A devaluation of 40-50% seems to be the norm. States may fear social unrest if taking more than 50% of people’s money overnight.

During Collapse

- Trade gold, silver or other wealth storing assets for assets whose price has collapsed, but, still represent good underlying value.

- Stay out of the way of those competing for food, water and essentials.

- Help whatever family and friends you can.

- Pay off your mortgage and all fixed debts denominated in the collapsing currency.

- Buy houses, land or whatever real estate you can use and manage.

- Buy equities of companies unlikely to be nationalized (If there are any) and who produce things needed to rebuild.

- Go bargain hunting with whatever you have left.

Shopping List

- Real Estate

- Farm equipment

- Fertilizers

- Agricultural commodities

- Energy producers

- Mining companies

- Oil producers

- Energy

- Forestry

- Manufacturing

- Mining

- Transportation

- Utilities

- Water

Real estate now shifts to a good buy as people dump it for essentials or to escape. You may have sold luxury condos and vacant rental houses prior to the collapse. Now is your chance to get them back … if you want ’em.

Gold Cost Average the Purchase of Real Estate

You can do it with stocks so why not with real estate?

It’s the same principle, just harder to imagine because real estate is rarely cheap enough to allow it. Instead of lamenting the nominal price drop of your house buy two or three more during the collapse. When things return to normal it will more than make up for what you overpaid in the housing bubble. By this time you may have already paid off your house with silver because the mortgage is denominated in fiat and you’ve got real money.

When sanity returns you will have saved yourself from being one of those guys you meet who got burned in Peru, Chile or Argentina and are still bitter over never having recovered from the collapse.

After the Collapse

Welcome to the latest third world country. Your neighborhood is starting to resemble the pictures from your last trip to Mexico. The middle class is gone or fled, labor is cheap, imported goods are expensive and the local goods get exported to countries that can afford them. Infrastructure disintegrates for lack of money and power outages are a way of life.

Try to look on the bright side: Markets have been cleared of toxic debt, derivatives have disappeared, entitlement programs have been cut or renegotiated and policy makers have learned their lesson!? Or is that being too optimistic?

Well, at least labor is cheap and you can afford a nanny for each child if that’s your style. And massages, spa treatments, manicures and dinner out will be as affordable as they were on that last trip to the Belize!

Don’t Be a Vulture

The problem with eating raw flesh and blood is that it’s not good for you. Vulture economics requires stomach bacteria for digesting flesh without remorse. You’re not a genius to be in a temporary position of strength with your fellow man. But, you have a chance to act like one for recognizing him as such. This is your moment to shine by using strength in an exemplary manner. The golden rule remains golden. Will you?

If someone offers diamonds for water give them water and let them keep their “precious” diamonds. Use the chaos to invest in assets and people who are going to improve lives. If anyone’s going to be left with capital to rebuild why shouldn’t it be the good guys?

“For to everyone who has, more shall be given, and he will have an abundance; from the one who does not have, even what he does have shall be taken away.”

– Matthew 25:29

1Shadowstats, September 9th, 2014

2In Peter Schiff’s 2007 edition of Crashproof

3When Money Dies: The Nightmare of the Weimar Collapse

by ADAM FERGUSSON.

4Peter Schiff, “The Little Book Of Bull Moves in a Bear Market”