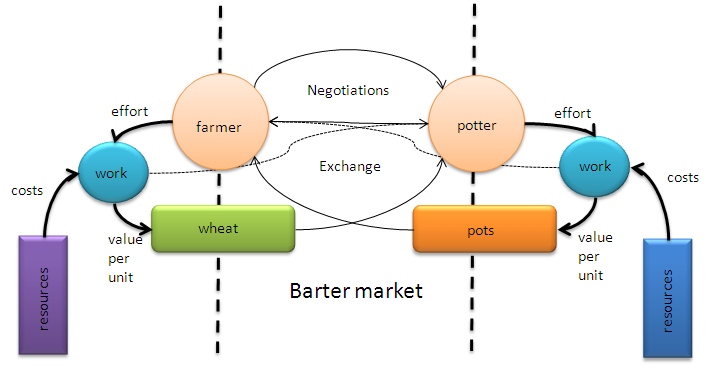

As promised by investor Lt. Col. Thomas Baker, the forensic reconstruction of Galt’s Gulch Chile has been completed and was hand-delivered to the FBI and the IRS on June 8th, 2015. Informed by the reconstruction, investor David McLeod filed criminal charges against Kenneth Johnson and Pamela Del Real in Chile (Docket number RUC 4710-2015) on May 20th. More US civil suits against Johnson are likely to follow.

On a phone call with Cathy Cuthbert, she described the forensic recontruction as a wellspring of previously unknown facts and details about what actually transpired around GGC. Timelines, Contracts, Accounting, Wire Transfers, Corporate reports, Recorded conversations between Johnson and investors, Videos, Credit reports, etc. showing Johnson to be at the heart of the problems surrounding GGC he has blamed on others. In other words, despite Johnson’s claims of working for the investors as a developer the reconstruction shows that the “service” Johnson has been providing them is similar to that which the bull provides the cow.

Readers of this GGC series will find it no surprise that Johnson used investor funds to spin a complex web of deceit involving multiple entities, off-shore trusts, multiple bank accounts, share swaps with Mario Del Real and others, inflated prices, ridiculous late fees, absurdly negotiated prices, etc. all while using corporate bank accounts like a personal checking account.

It’s tempting to leave Jeff Berwick out of discussions about GGC now that he’s so publicly apologized. Unfortunately, his involvement in cutting Cobin and German out, starting a different entity into which to take title (IGGSA) and trying to get the New Zealand trust and offshore structures in place is quite evident in the reconstruction documents. There’s little doubt Ken Johnson was the instigator of the most serious problems with GGC, and continues to make all things worse with his presence and current behavior. However, to say Berwick wasn’t right there at the beginning is to not tell the story, correctly, at all. As mentioned in Part 3 my hope is that Berwick will externalize his contrite heart into some modest assistance to ongoing recovery efforts or investors in extreme need. With the introduction of these new charges, with more to follow, the publicity surrounding the aftermath of GGC is not going away, anytime soon.

Note: The criminal charges filed by David McLeod, and some documents of the forensic reconstruction I was able to coax from the recovery team, have been added to the free E-book, “The Creature from Galt’s Gulch”. I will continue to add such elements to the book as I receive them and within the boundaries of preserving the privacy of the investors.

Justice Provided by the People Involved

As described by Cathy Cuthbert and Thomas Baker, the breadth and depth of the forensic reconstruction they’ve put together is quite impressive. It’s not only a meticulous investigation and gathering of documents but they’ve formatted the whole thing into a package that makes it accessible to outside parties.

I’m not sure what may have transpired between Tom and Ken but the USMC motto of “No better friend, no worse enemy” might echo in Johnson’s mind for some time to come. That is, if Johnson is able to comprehend what has just happened to him. The agencies he’s just been reported to will hound him for the next decade. Half of that decade will be spent defending himself against the criminal charges that were filed against him in Chile on May 20th, by David McLeod. And, there’s more to come. A rather obvious tip to Johnson would be: The next time Tom makes an offer of either “Friend” or “Enemy” . . . go with the former choice. Who knows? Maybe the recovery team would still let Johnson wiggle out of his fraud if he’d just hand over the land the investors paid for.

The FBI white collar crime fraud division will find that most of the investigative, forensic accounting, and reconstructive work has been done and hand-delivered to them by the recovery team. With so much work already complete perhaps the agency will bump the case to the top of their case-load so they may stand in front of their logo at a news conference and receive some good publicity.

The Del Real Factor

Johnson is solely responsible for inviting a local Chilean, Mario Del Real, into GGC affairs. And yet, investors have been made to suffer Johnson’s endless complaining about problems he’s had with Mario and his daughter, Pamela. That’s because Johnson performed a bizarre GGC stock swap with Mario hoping to make big money on the value of water in an Andes Water company called Rio Colorado. By the time the smoke had cleared Mario owned most of IGGSA and his daughter was the general manager of the company! In other words, Johnson was no longer the dominant share holder of GGC and had lost all control over the entity that holds the land. What great “Development” work, Ken!

(To understand more about this failed deal see Chapter 7, “The Rio Colorado/GGC Share Swap”, in the GGC E-book.)

If you’ve read my “Stolen Car Metaphor” at the end of Part 7 you know my take that Johnson’s epic fail with the Del Real share swap is merely the lamentations of a thief who bungled and lost the proceeds of a previous theft. The fact that Johnson’s audience for these lamentations are the victims of the first theft is exactly the kind of behavior I find consistent with Dr. Robert Hare’s psychopathy checklist.

Any deal Johnson made with stolen shares of stock can, and should be, overturned. Therefore, whether the Del Reals colluded with Johnson, or are merely his victims, is a matter for a judge to decide (Yes, there is no longer any way to resolve GGC disputes without involving state agencies, unfortunately). Pamela Del Real’s resume (She’s now the general manager for IGGSA) shows substantial accounting expertise. Such expertise will make it impossible for her to plead ignorance if there was any foul-play on the Del Reals part.

Johnson’s Latest Ploy, Revealed

Johnson has now revealed his latest ploy and what’s behind his re-occupation of the GGC hacienda and grounds. And, surprise, surprise, it’s a variation on his usual … lies mixed with just enough truth to confuse and divide his listeners against themselves while holding out a carrot and stick for those who either cooperate or resist.

More specifically, Johnson is trying to confuse and divide investors against lead investor Josh Kirley hoping they’ll put pressure on Josh to relent in his legal actions which have locked up Johnson’s sale and pillage of IGGSA assets. He also wants the investors to help him get rid of his “Del Real” problem. The carrot Johnson offers is the same old title to land he’s been promising investors, and not delivering, for the past two years. The stick is his continued presence and purported counter-attacks on investors who “continue to attack him”. For those not familiar with Johnson-speak, the word “attack” describes the actions of anyone who points out to Johnson another of his own broken promises.

If only the investors will help him convince Kirley to relent, and help him get rid of the Del Reals, then Johnson can deliver, at long last, the coveted Titles to actual land the investors have been pestering him about, all this time.

E-mail Between Host and Parasite

A recent e-mail exchange between Josh Kirley (The host) and Ken Johnson (The parasite) is an excellent illustration of what actually went wrong with GGC. It’s also an excellent example of what happens when “The creature” is confronted with truth.

My thanks to Josh Kirley for making this e-mail exchange available:

On Thu, May 28, 2015 at 12:27 PM, Josh Kirley <joshkirley@gmail.com> wrote:

“Ken,

For two years, you keep sending out the same emails. Always full of juicy drama, promising the release of more information in the future. This behavior is unprofessional. It inspires no confidence. Why can’t you just do your job?Try building something. Try living up to your responsibilities. Produce something. Be accountable. If you are GGC’s Minister of Propaganda, who is the Project Manager? Your accusations are baseless and defy all logic.

Tell me if you can refute the accuracy of the following facts. I swear to their order and authenticity.

1) You are wholly responsible for bringing the del Reals into this nightmare.

2) You pleaded with me to give 1 to 2.5 million dollars to Mario del Real for his Rio Colorado Project. You personally vouched for Mario, insisting the Rio Colorado deal was a “No Brainer” and a “Homerun”

3) I told you that I had my suspicions about del Real and would get back to you after performing some due diligence.

4) Once I told you that I was not willing to put money into a second Chilean investment, you totally reversed course.

5) You refused to provide me with del Real’s Ruta number, or even his full name, intentionally stonewalling my attempts to research his background.

6) You told an entire room full of defrauded investors at the second festival that your deal with del Real was a “totally separate” matter between you and him.

7) You told all of us that your alliance with del Real was “none of our business” and would have no impact on our contracts.

8) When I offered to pay, out of my own pocket, to have del Real looked into for you, you refused my help, saying that you feared if I looked into del Real, he might “get spooked” and walk away from your deal.

9) Weeks later, you came back to me, begging for a million dollars. You said that you were double crossed by del Real and you needed me to buy back the shares that you gave to him.

10) When I would not bail you out, you predictably changed your characterization of my relationship to the project from savior to saboteur.

I’m sorry if I cannot respond to each of your lying emails. But, I have to give priority to my day job. I suggest you do the same. Maybe start by paying employees, repaying loans, and living up to the contracts you signed.

Josh Kirley”

The Parasite Responds

“Josh,

As you know, you are lying about most all that you discuss. There are communications between you, Monica Wehrhahn, Ken Carpenter, Alison Sherman, the Del Reals and more. Do you think that those just disappear because you are now pitching your false storyline to yet another news outlet? This has always seemed to be a publicity stunt for you, just as GGC always have been for Jeff Berwick.”

Johnson then goes on a bizarre rant about Jeff Berwick and BitcoinATM, Wire Transfers, Cafayate, Argentina (If you can believe it) and ends with:

“We are working on completing what Mr. Aguirre was unable to complete, or was unwilling to complete. We are working to fix the $1m+ damages that those labeling themselves “rescuers” of GGC have inflicted upon the farm, buildings and property. We don’t spend our time pitching a false story line for our own publicity, as Mr. Berwick and yourself seem to focus on quite a lot.

Ken”

Notice that Johnson does not dispute, nor even address, any of Kirley’s questions or statements. This is the way e-mail “Exchanges” and “Dialogues” go with Johnson. For readers who may have wondered . . . “Why don’t they just ask Johnson if [Insert simple question here] the above exchange with Josh Kirley is your example. Josh speaks the pure truth and asks sincere questions and, in response, Johnson doesn’t respond, at all.

The last paragraph is classic Johnson-speak. For readers who don’t understand the dialect his e-mails usually end with a payoff like this if you know how to read Johnson-speak. That is, you take all accusations as a literal description of what Johnson, himself, has done or is doing. In his last paragraph, therefore, we learn that Johnson has caused more than a million dollars of damage and is pitching false story lines for his own publicity.

Johnson’s Assaults

I’ve spoken with two people who were physically assaulted by Ken Johnson. The first was a young man Johnson tried to push around (Mentally and physically) during Johnson’s employment with The Dollar Vigilante. This young man would not tolerate Johnson’s nonsense and was the first person to speak up to Berwick about his suspicions about Johnson poisonous behavior. If Berwick had listened it’s anyone’s guess how Galt’s Gulch Chile might have played out without the involvement of Ken Johnson.

The second assault was that of a 70-year-old Salesman that worked for GGC who didn’t fare so well in the “Encounter”. Sandy “Clarence” Sandfort was grabbed by the lapels and thrown over a couch by Johnson when he learned that Sandy was about the leave Chile after all of Johnson’s promises had remained unfulfilled. Sandy was severely bruised and Johnson had almost managed to break a few of Sandy’s ribs. He was so shaken up by Johnson’s assault that Berwick had to fly in the next day and negotiate an NDA and payoff to keep Sandy quiet about the assault. Johnson later broke the terms of that NDA by talking about the assault with a third-party. Hence, Sandy’s retelling of the assault to me.

and Taunting . . .

Tatiana Moroz, who worked for Ken Johnson and wrote the GGC theme song, shares her experiences with GGC and with sociopaths in the liberty movement. Most of what involves GGC is in the first 25 minutes of the video, but, the ladies (With Julia Tourianski, BraveTheWorld.com, and Gigi Bowman, gigibowman.com) go on to tell other fascinating stories around the theme.

https://www.youtube.com/watch?v=KqQW5a4dJMk

Contrast the story Tatiana tells in the above video with the excitement she started out with and you’ll get a feeling for the roller coaster ride that was GGC. Tatiana perfectly captures the cognitive dissonance felt by most who’ve followed the promise, and then the reality, of GGC in the hands of Ken Johnson.

Favorite excerpts:

“This nonsense [Sociopaths in the Liberty Movement] is disgusting and ridiculous … and what’s gonna happen, here, is that people are going to leave and they’re not going to want anything to do with it (True Liberty) and all we’re going to be left with is the dirtbags who think this kind of behavior is ok. … And I’m sick and tired of the people that are trying to call attention to the sociopathic behavior within our own movement getting trashed.”

Tatiana’s right, of course. Natural law doesn’t evaporate around people who wish to retain and use their liberties. If anything, we must be more mindful of universal human truths because we are the people exploring the boundaries of liberty. A tolerance for lies, manipulation, sexual assault, and broken contracts is not “What’s up!” in Liberty. Anyone claiming that such tolerance is “Cool” is not a libertarian. They’re just another asshole in disguise.

John Cobin Interview

I had the pleasure of interviewing John Cobin about GGC for 1.5 hours, last week. The interview was mostly for my E-book about GGC. However, of interest, here, is the remarkable consistency of Dr. Cobin’s story with everything he’s said from the very beginning. Cobin is abundantly forthcoming about every meeting, document, e-mail and conversation he’s had with respect to GGC. My reaction to the interview was to tell him that it was a pleasure to speak with someone involved in GGC that looks better and better with each discovered and documented fact about the project.

Cobin said the impression he got from Jeff Berwick and Ken Johnson was that, they alone, might be able to supply the funding for GGC. He had no idea that they would, almost immediately, take his extensive research and information about Chile and GGC and cut him out of the deal. Although he concurs with the possible psychopathy of Johnson he puts Berwick in the same category in terms of the way they defrauded him. And yet, I had the impression that, even now, he would be forgiving of Berwick if approached in some meaningful way to make restitution.

Cobin said Johnson came after him, very agressively, in a libel suit in Chile. Guess what happened when the court date arrived? Johnson was a no-show! I won’t compare a libel suit with a podcast debate, but, I’m becoming quite familiar with Johnson’s cowardice in the face of someone determined to tell the truth. So far, Johnson’s been a no-show on two podcasts about GGC that he, himself, dared me to participate in.

For those interested in Chile I highly recommend the interview James and Johnathan conducted with Dr. Cobin on Monday over at Borderless. Cobin proves himself to be THE reliable source for all of Chile and much of the rest of the “Expat” world, as well. Cobin’s book, “Life in Chile” greatly increased the effectiveness of my 21-day country-vetting trip to Chile in 2012. I look forward to reading his latest book, “Living in Chile” when I can come up for air over the summer.

GGC Theatre

Johnson has been roaming around the property making absurd videos in an attempt to document the damage done by the recovery team. Perhaps the investors share my hope that Johnson continue making these videos as they are helpful in documenting what Johnson, himself, has done.

One of the things Johnson harps on in the videos are the “Damages” done by the recovery team causing a poor yield from the wells. In fact, such poor yields were caused by Johnson’s complete ignorance and inept handling of the well work around the property. Despite the pleadings of the local workers Johnson put Manuel Hermosillo in charge of the wells and the work was terribly bungled. And yet, somehow, the investors end up blamed, yet again, for Johnson’s incompetence. Such GGC Theatre might be a useful prop to help Johnson influence the Chilean locals who have no idea what’s going on with GGC. To those who’ve read the first thing about GGC, however, they are just that much more documentation of Johnson’s failings.

Message to local Chileans:

Johnson’s accusations of others are a reliable confession of his own failings. There is truth in many of the disasters he documents but your messenger is the culprit, not the victim. Johnson’s “Investment” into GGC remains at zero while 76-investors and buyers have given $10.45 million dollars for the purchase of everything you see associated with GGC. 72 of the investors have been begging Johnson to leave for over a year.

What happens next?

First, most of the predictions made in Part 6 seem to be coming true. That includes Johnson hinting that he wants to sell water rights, again. Happily, he’s unable to do so with the current injunctions in place.

Johnson has some time while the ocean water recedes in preparation for a tsunami of new legal problems.

Some think Johnson will stick it out to the end because his claim to be “Working for” the investors is his only defense against the legal actions that have been filed against him. But, Johnson also claims he controls or owns everything (Vacillating between claims of control or ownership) depending on his audience and the phases of GGC. How could someone who owns everything be an employee? How could a trustee (Controls everything) claim to be a trustee of beneficiaries who have been begging him to leave for the past year?

Perhaps Chile, and the local populace of Curacavi, will no longer tolerate Johnson as the criminal charges pile on. If he’s made to flee then we may see more pictures of his backpacks of stolen money while he’s on the run. I think he still has a Paraguayan passport from the passport scandal he was conducting at TDV. Still, all these charges filed with state agencies will haunt him wherever he goes. As of today, Johnson has put a digital data noose around his own neck that will follow him around the globe.