Chile is on the short list of ex-pat locations for my family. We’ve been vetting countries for the past eight years and are far along in the process with second passports and visa’s in hand. Such documents are probably a luxury but exploring that question is for another day. In this article (Part Two) I offer perspective and constructive criticism of the Galt’s Gulch, Chile (GGC) land development fiasco. To come up to speed on the story, and for reference while reading this article, see Part 1: Galt’s Gulch Chile — Story, Timeline & References.

Root Cause

This fiasco has little to do with the Randian, libertarian, or anarcho capitalist ideals referred to in the marketing hype. The social, political and economic philosophies, purported to be at the heart of GGC’s failure, are only now coming into play in the attempted rescue of the project. What killed the deal was what kills most deals: The psychopathic behavior of a partner in a key role and the inability of the other partners to recognize and eject him in time. A contributing factor was Berwick’s silence, yet continued marketing hype, despite direct knowledge of egregious mismanagement and theft. Another contributing factor was the support of Johnson by investors who, understandably, needed more time and evidence to be convinced of the extent of Johnson’s misdeeds.

I’m being quite careful in my use of the word “Psychopath“. I am not a mental health professional or qualified to make a clinical diagnosis. However, “psychopath” is the word Berwick uses, in public articles and radio interviews, to describe Johnson. After studying all public documents my layman’s opinion is that, to Berwick’s credit, he is correctly naming Johnson’s pattern of behavior and that it is consistent with the testimony of multiple eyewitnesses.

Not Guilty by Association

The world is full of successful “libertarian” projects. What distinguishes them from GGC is that the political-economic philosophies of the participants were not the primary marketing lure of the project. Because Galt’s Gulch dared to use a famous Randian catchphrase the fact that it was taken down by a psychopath, like most deals are, is becoming associated with the philosophies of those involved. In fact, the philosophies and aspirations of the investors and participants in GGC had no bearing on its failure. They simply failed to spot Johnson’s egregious behavior, in time. According to eyewitnesses (John Cobin, Jeff Berwick) Johnson had no grasp, whatsoever, of libertarian principles prior to his involvement in GGC. It remains unclear what principles, if any, might explain Johnson’s predatory, aggressive and anti-social behavior.

Natural Law Prevails, Naturally

Much has been made of the irony of anarcho capitalists having to rely on the state for justice when deals go awry. No such thing has yet to occur with respect to GGC. In fact, the state has done nothing to restore funds, order or justice to GGC participants. The only entity to make progress on those fronts has been the GGC participants, themselves. Specifically, the GGC rescue team, a band of investors and members who have a personal and financial interest in restoring order to the project.

On October 23, 2014, the GGC rescue team met with private attorneys and security at the Santiago airport and were able to garner local support of their restorative efforts. What garnered their support, and made the GGC rescue team’s efforts successful, was their restorative intentions and the ground they held: The moral high ground. The locals were convinced the team had given an honest account of the situation and had the intention and means to oust squatters, clean the place up, meet payroll for the farm workers, restore utilities, and bring accounts current. Using private funds the rescue team proceeded to do all that they had promised.

What Do I Care?

I care because I’m a libertarian interested in living in Chile. In public articles and extensive comments about GGC, thus far, I see stories, facts, and the usual name-calling from the uninvolved, but little to no constructive criticism.

I care because this deal is being cited as “proof” that libertarians are unable to trade with one another in peace without resorting to state agencies.

I care because libertarians have long-term concerns about the negative exposure GGC might bring to perfectly great ideas such as not aggressing on one another and letting free markets reign:

“That is why people like me are so pissed off. Berwick has not just defrauded people. He has discredited the anarchist movement, the start-up community movement, and discredited authors like Wendy. He played right into the Marxist stereotype of what a venture capitalist is: the Zeitgeist people and the socialists are going to have a f*)#$& field day.” —Jack O’Brien commenting on Berwick’s first public Mea Culpa “communique”.

I care because the simplicity of flying to another country to live, for a while, is becoming associated with the tar pit of foreign land development. One has nothing to do with the other.

“As long as there are nations, changing your nationality should be as easy as changing your cell phone plan.” —Michael W. Dean, Freedom Feens Radio Show & Podcast.

I care because what every businessman, and especially libertarians, should be learning from this fiasco is that people can’t do anything in peace with a psychopath running the show. Recognizing them in time and screening them out, in advance, is crucial for human liberty and success.

Chile and Me

My first trip to Chile was for seven days in 2011. My wife and I liked it so much I went back in 2012 with a friend and spent 17 days scouting most of the country from Northern Patagonia to Santiago. My libertarian friend and I split the costs of rental cars and hotels and drove wherever we wanted for over three weeks. By the time it was over we’d vetted every place in Chile that would meet the needs of our families.

A Dryer Sonoma, CA — Ideal for GGC’s Demographic

The location for GGC is a dryer version of Sonoma, California. Those familiar with Sonoma know that it can be quite dry in the summer. The location for GGC is dryer than that. Chile is one of four places in the world with a perfect Mediterranean climate. The borders of the country enable the luxury of dialing into that perfection by going north (For hotter and dryer) and south (For colder and wetter). Since my subjective view of perfect climate is a little cooler and wetter than the GGC location (33° 16.287’S, 71° 7.284’W) my preferences are south of Santiago.

Though the location is dry for my taste it’s ideal for the target demographic. Between the ocean and Santiago, and nestled in (Dry) wine country, it would meet the needs of jet-set ex-pats and self-sufficient” preppers, alike. The near perfection of the choice of location is no accident but that of long-time Chilean resident, John Cobin (Not Jeff Berwick, et. al.).

Nothing to See in December of 2012

Much like today, there wouldn’t have been much to see of “Galt’s Gulch” on my last trip to Chile in December 2012. My wife and I had breakfast in Curacavi in 2011 on the way to Vina del Mar and enjoyed a wine tasting tour of the Curacavi. area. In December of 2012, If my friend and I had known about GGC’s marketing existence, we would’ve skipped it, anyway. We were both familiar enough with the road, vineyards and terrain between Santiago and Vina Del Mar. The only point in making such a drive would have been to meet John Cobin. My friend and I wanted to see the entire country, for ourselves, before doing that. Here’s the view from a small plane flying in and out of Curacavi. GGC is 17 kilometers north of the city in the surrounding mountains.

John Cobin is the Real Deal

John Cobin is the talent behind the discovery of GGC’s ideal location, the business plan to develop it, and more: Chile, itself, as one of the best alternatives for liberty in the southern hemisphere. He ranks those alternatives, in order, to be Chile, Panama (A distant second), Colombia (Could be the new Chile in 20 years) and then New Zealand though says one would have to distinguish between economic and social freedoms to make a personal choice.

Cobin moved his family and six children to Chile in 1996 and has written four books about living in Chile. I read his “Life in Chile – 2011 Edition” prior to the second trip and can vouch for its accuracy and expansive detail. Although Chile remains Cobin’s #1 choice he pulls no punches about the difficulties of living there. It’s hard to read, at times, as he dispels romantic notions that are hard to let go of when one is still wallowing in the excitement of the journey to such a magical place. In the end, however, Cobin’s honesty makes Chile even more enchanting because he makes its magic accessible. Cobin has been to every city in Chile with at least 500 people. This volume of exploration, combined with his knowledge of economics and politics, gives him a remarkable grasp of the country and the pros and cons of each area and village.

Any libertarian who had done a half-hour’s research into Chile would have discovered the wealth of information Cobin has made available online for free to those interested in living there. It should be no surprise to potential ex-pats or GGC investors that Cobin is at the heart of all the good parts of the original deal. What I find surprising is there are no public references to investors absorbing Cobin’s material as the low-hanging fruit of their due diligence.

Cobin and GGC

Cobin found the land, made an extensive business plan, was making calls to possible investors (This is how Berwick found out about the deal) and had partnered with Eyzaguirre to formulate a plan to unlock the all-important water rights and subdivide the land. Cobin referred to the project as “Galt’s Gulch, Chile”.

One of the keys to understanding Cobin’s rather perplexing involvement of Berwick and Johnson in his project is Cobin’s recognition of his limitations. He is an academic professional and author and inexperienced with raising the significant amount of capital required for his business plan. Cobin saw Berwick as a plausible means of raising such capital and made a straightforward agreement with Berwick and Johnson to do so. Cobin had them sign over power of attorney so he could act on their behalf to create a holding company and bank account. Cobin and Eyzaguirre were to receive a $250K finders and negotiation fee (Later increased to $285K) for property #1 (El Penon) and 20% of the holding company. Shortly after agreeing to these terms Berwick left Chile leaving Johnson to do the “land development” work of their partnership. Cobin and Eyzaguirre were about to cut through the Chilean maze of unlocking and inscribing the water rights when Johnson went, inexplicably, incommunicado. Contrary to all agreements Johnson created an entity that only he controlled and used money that Berwick attracted as investment capital to take title to the land. Unable to speak Spanish, and with no local or administrative experience, Johnson, predictably, bungled the process for aggregating and inscribing the water rights. Although Johnson cut all ties with Cobin he blames Cobin for “finding a property with no water rights”. Johnson then proceeds to spin a bizarre web of land, stock and company swaps and, with no money to spend, commits to the purchase of a second property for $6 million dollars. This is property #2, El Lepe. Fast forward to today, 12/17/14, and the GGC rescue team is still trying to unravel Johnson’s bazaar web.

The Talent Left the Building

When Cobin was betrayed by Berwick and Johnson the talent to make the project happen, namely Cobin and Eyzaguirre, left the building. Cobin and his partner knew what had to be done to unlock the water rights, subdivide the parcels and assign title to the lots to make them transferable for purchase. They were cordial and on honorable terms with the locals, spoke Chilean Spanish(!) and familiar with the quirks of accomplishing administrative tasks in Chile. Johnson, who Berwick left “in charge” of their purported partnership, had none of these advantages and was a poor candidate to accomplish anything in Chile (Or his native country judging by Berwick’s description of his awful behavior while working for TDV).

From what I can gather it appears the GGC Rescue team will, eventually, have to come to some kind of agreement with Cobin for the original GGC deal on property #1. They may as well accept what Berwick understood from the beginning: Cobin and Eyzaguirre’s insight and expertise are crucial to turning this dream into reality. All agree the project must be renamed as part of the restoration. However, merely throwing more money into the deal without also adding talent commensurate to Cobin and Eyzaguirre’s will not be the ingredients for progress. Even if the right balance of talent and money is struck one can only hope that Johnson hasn’t soured the local taste for gringos.

Freedom Orchard?

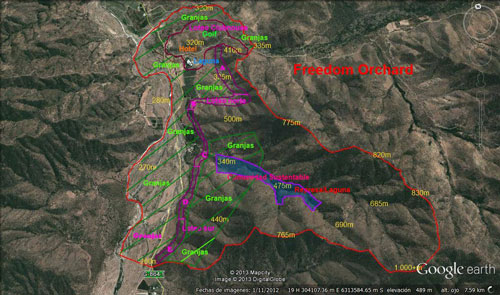

Freedom Orchard is what Cobin and Eyzaguirre had to rename their separate land development project after Berwick and Johnson co-opted, and ruined, the GGC name. This is probably a blessing for Cobin as Chileans have a hard time saying “Galt’s Gulch” and Cobin’s original vision was not for the project to be exclusively libertarian but open to everyone. Adding to the confusion is that some of the photos on the GGC website and Facebook page are photos of Freedom Orchard and neighboring farms. Freedom Orchard is a separate property, better located and more fertile, directly south of GGC property #2, El Lepe. Some confusion about the distance between GGC and Freedom Orchard has resulted from not distinguishing between El Penon and El Lepe. Driving North from the freeway one must drive through Freedom Orchard to get to El Lepe, first, and then to El Penon.

Red Hot Chile Radio- Liberty and Life in Chile with Dr. John Cobin

GGC and Freedom Orchard are discussed in the following episodes of “Red Hot Chile”:

- 8/29/14 – 24:50 – 53:00, 45:45 – How it all started.

- 9/5/14 – 41:00 – Quick interview of Berwick, 42:30 – Cobin and Berwick discuss the terms of the original deal.

- 9/12/14 – Cobin Interviews Berwick for most of the show.

Psychopaths are a Primary Adversary

An important lesson to come out of the GGC fiasco is for libertarians to learn how to spot this human adversary and screen them out of all affairs. With no conscience, the inability to empathize, a parasitic nature, the pleasure they derive from causing pain, and their affinity for seeking power over others, the psychopath has aggression at the core of their being. They can be relied upon only to throw a monkey wrench into every situation with which they are involved. Until they are removed, or screened out in advance, it’s an exercise in futility to attempt to accomplish anything.

Paul Rosenberg provides a great introduction to psychopaths and the importance of avoiding them in They Walk Among Us:

“Here’s the bad news: Predators walk among us, and they are indistinguishable from normal people. These differently wired humans have a predatory advantage, and they use it. This is not a plot from a scary movie; this is real. I am deadly serious about this, though by the end of this column, I will also explain why there is also good news. These predators are called sociopaths (psychopaths in the clinical literature). They rather seldom damage our bodies, but they make careers out of bleeding our souls.”

When …

Every request is ignored, every admonishment reflected back to you, every task left undone, every responsibility shirked and blamed on someone else, every agreement pretended to never have taken place, when you find yourself dragged into a world of complete inversion… consider the possibility that a psychopath is “walking among you”. Learn how to spot a psychopath and the different types and terms for them.

Psychopathy Checklist

I was impressed that Josh Kirley ran a background check on Johnson and that nothing came up that would alert investors. Perhaps such background checks should be supplemented with an informal check against the psychopathy checklist put together by Canadian psychologist Robert D. Hare. Another useful trick is to think of the psychopath’s story as a 3D illusion (An autostereogram) that can only be seen and believed by the victim when the mind muscle that controls focus is coaxed into relaxing.

Signs, Signs, Everywhere a Sign

The most common word Berwick now uses to describe Johnson is “psychopath”. I don’t fault Berwick for not recognizing Johnson as a possible psychopath. In fact, it’s a sign of normalcy to be confused by psychopathic behavior upon first encountering it.

What I fault Berwick for is moving forward with Johnson, or with anyone, who had behaved as badly as Johnson had leading up to the critical decision of partnering with him. A clinical diagnosis, or even a layman’s understanding of psychopathy, was not necessary for Berwick to know to walk away from someone lying about, and assaulting, his employees. No expertise is required to part company with a partner insisting that business begin with the selling of a product they don’t own. Berwick’s inability to put a name to Johnson’s behavior has nothing to do with his bad judgment in tolerating it.

That Johnson had behaved so badly, from any perspective other than his own, was a luxury that most who are first encountering psychopathic behavior don’t get. If Johnson is ever clinically diagnosed he will be seen, in retrospect, as an easy one to spot. Berwick, and libertarians in general, will need a more refined antennae to increase their batting average of avoidance. Berwick refers to the following warning signs prior to agreeing to the 50/50 GGC partnership with Johnson:

- Johnson’s claim that “he could sell anything to anyone” is an admission of being able to lie with no guilt or shame.

- Johnson was at odds with everyone in Berwick’s office and physically assaulted one of Berwick’s employees. Berwick would have been familiar with his own employees and, presumably, able to determine whether Johnson was lying or distorting facts about them.

- Johnson wanted to begin their partnership by selling land neither owned or optioned. Even if they had an option on the land there were serious legal obstacles to overcome to make lots ready for resale. To Berwick’s credit, this was a point of contention that almost lead to a fistfight with Johnson. Perhaps it would have been better for future investors, and Berwick’s reputation, if some kind of gentlemanly fistfight had resolved the matter.

See Part 3 of this article for:

- Contracts are Good for Libertarians, Too

- Slow is Fast

- The Contract and Natural Law as Rules for Self-Government

- Rules Without a Ruler

- Mediation First, State Courts as Avoidable Alternative

- Bitcoin & Alternative Currencies

- Privacy is Not Partner Leverage

- Libertarian Version of 1 Corinthians 6