I’ve spent the last two days responding on the comment section of an article written by Rebeca Morla at the Panama Post. Though I find the article represents mostly Johnson’s point of view I sympathize with any journalist under deadline having to come up to speed on the Galt’s Gulch Chile project. I was informed by a comment on Doug Casey’s International Man forum that Rebeca used this series to prepare her article. I look forward to more articles from her and the post in the future. Also, James Guzman followed up with a brief article on GGC, as well. The only thing I might change about Guzman’s article is his reference to the rescue team’s entrance to the property, last October, as an “armed capture”. That probably comes from Berwick’s article referring to it as a “SWAT Raid”. My understanding is that there were no guns and no violence involved in the recovery team’s entrance to the property. I make that distinction because it’s important to libertarians and because Johnson’s recent reoccupation did, in fact, involve the use of a firearm. As I’ve pointed out in previous articles, Johnson is no libertarian and should not be confused, in any way, with the principles of Ayn Rand’s “Atlas Shrugged” from which the name Galt’s Gulch is derived.

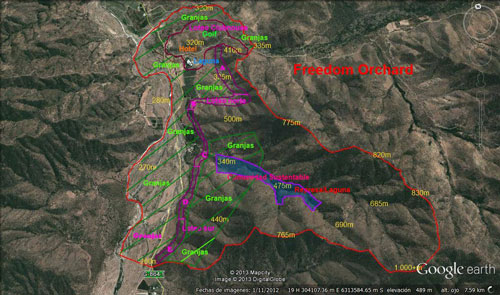

With Mario Del Real already in control of “El Penon” (GGC Parcel #1 of 2) farm workers working on “El Lepe” (The second and largest parcel of land that comprises Galt’s Gulch Chile and it’s offices, hacienda and lemon trees) reported, last week, that, under threat of violence by three hired thugs (One concealing a gun), Ken Johnson has taken back occupation of “El Lepe”. Below is the narrative from farm managers Renzo and Ken Carpenter as sent out to investors on Wednesday, April 22nd.

Friday, April 17th at the farm:

- Farm worker, Jaime Olivares, while cutting espino trees saw Manuel Hermosilla walking inside the property. When confronted Hermosilla said that he would kill Farm Manager Diego.

- The Farm Managers made a complaint with the Curacaví police against Hermosilla for entering the property and making his death threat.

Monday, April 20th, at the farm:

- At 8:30 pm, Ian Thornton and three thugs with a pistol, arrived at the gate and said to Diego and Coto, “Open the gate. We are coming in, one way or another.” Diego let them in.

- Ian confiscated their telephones.

- Coto, from a hiding place, was able to communicate with Renzo who was in town on farm business. He alerted Renzo as to what was happening.

- Renzo phoned the police. By the time the cops arrived, Ian had put new chains on the gate so Renzo and the cops could not enter the property.

- Renzo called Ian from the gate. Thornton said to him, “You have two options, cooperate or go to jail for the things you sold.”

- Former developer Johnson arrived around 11 pm, inspected the house, and left with the IMac Desktop computer.

- Thornton offered Renzo work if he would cooperate.

- Thornton said that no employee would be paid this week, but would be paid starting next week.

Tuesday, April 21st, Morning, Santiago:

- Former developer Johnson arrived with two police officers at Kenny’s apartment in Santiago.

- Police showed proof of GGC ownership of the Jeep to Kenny.

- Kenny explained to the police that the jeep was voluntarily loaned out and the keys handed over to him. He gave the cops the keys.

- The police ask for a GPS and computer, but Kenny told them that he didn’t have any registered company property. Johnson called his lawyer who advised him to tell the cops to take only the jeep.

- Johnson said that Del Real is about to go to prison and anyone aligned with him is in trouble.

Both the farm and the jeep are in improved condition from when The Recovery Team took possession of them. We have photographic evidence of that. The employees were paid up to date, and we were current on all bills.

Thursday, April 23rd:

The GGC Recovery Team received a report from Curacaví this evening that Johnson presented one of the farm managers with a criminal complaint for selling various “antiques” and old equipment around the premises to raise money for salaries and operating expenses. The farm managers were interrogated by Johnson’s lawyers and the PDI (Chilean FBI equivalent) for hours.

NOTE: As of May 3rd, 2015 there are no criminal charges on the court website. Johnson may have had a lawyer write up charges but it’s doubtful he would spend the money to file them.

Recovery Team Reaction

These are bullying and intimidation tactics. Former developer Johnson knows full well that the money was used to pay workers wages and operating expenses of an unprofitable farm. What does this say about him, that this swindler who defrauded a group of international investors of $10 million would use the cops to intimidate his former employees, the very men he, just a few hours before, terrorized with Santiago mafiosi? What does it say about Jerry Folta who bankrolled Johnson? And what does it say about Chile?

Regarding Johnson’s reoccupation, Cathy Cuthbert writes:

“The second Johnson Reign of Terror begins, *yawn*. At least we don’t have to worry any more about Diego and Renzo being knifed in the middle of the night.”

“We were well aware that something like this might transpire since for about four weeks, we’ve had evidence of Johnson’s goons casing the farm, and noted several amateurish attempts to gain inside information and stir up dissent among the Recovery Team.”

“While Johnson and Thornton celebrate their Pyrrhic victory, Uriah Heep-like as is their habit, we are reminded of that priceless scene from Tin Men.

The facts are these:

- The expenses of the unprofitable farm are off our backs. All the legal fund money will go to legal fees at this very important juncture.

- The harvest season is essentially over so there’s no income now, anyway. This is the least profitable time of year and excellent timing for us.

- Johnson’s prodigious liabilities are intact and increasing.

- The Recovery Team is relieved of management responsibilities, giving us more time to concentrate on the upcoming litigation.

- Former developer Johnson now has a golden opportunity to prove he can keep his commitments.

We achieved our goals during our tenure at the farm. We blocked former developer Johnson from misappropriating this year’s harvest income. We paid the farm workers their back pay, pension and health contributions that Johnson owed. We acquired valuable information for our criminal discovery. We’ve made friends and contacts in Curacaví. We demonstrated to the community that we are willing to pay debts. We improved the condition of the farm after years of neglect.

The most important news is that Diego, Coto and Renzo are safe. Whether they continue to work on the farm or find other positions, we thank them for their service to us and wish them well.

The most important take away from this update is that our litigation plans are not affected by this violent act. In fact, we’re better off.”

Let Johnson Meet His Obligations, for a Change

Johnson used investor money to purchase the property and received title to it in his own personal entity (Inmobiliaria Galt’s Gulch SA) and not the entity created by the originating partners to receive title (Galt’s Gulch Chile SA). He’s been responsible for paying all bills, taxes, salaries and maintenance costs of the property from the date of the sale and up to the present day. When the recovery team visited the property, last October, the place was in shambles and the recovery team took it upon themselves to bring all bills, taxes and salaries up to date and clean the place up. From the standpoint of the fraudulent legal title under which the property is currently being held, the recovery team was under no obligation to make such payments. Such remains the case, today.

Of course, Johnson’s MO is to have his cake, eat it, charge others for it, demand someone pay for a new cake and the cost to refrigerate it, refuse to acknowledge that there ever was a cake, accuse anyone within sight of having stolen five cakes, and assaulting the bakers wife! Will this translate into Johnson claiming that Mario Del Real is responsible for all GGC obligations because thief #2 (Real) stole the booty from thief #1 (Johnson)? Johnson’s recent history shows that, if one can imagine it, Johnson can do it, claim it’s the truth or accuse someone else of doing it. The least likely of all things to occur is that Johnson will keep his word to anyone or anything he’s talked about.

No Honor Among Thieves

Johnson appears to have been out-swindled by Mario Del Real who somehow ended up with a significant portion of the shares of Johnson’s personal entity and, therefore, ownership of GGC. Johnson is suing Mario Del Real regarding this transfer/sale. Though he claims to be active in the suit, records show there has been no activity on it since November of 2014.

The investors have been requesting, then demanding, that Johnson share accounting and legal documents with them for 205 days, now. Johnson has been putting them off by returning their requests with either accusations or document fragments that are available to the public. Using Jerry Folta as an intermediary, Johnson recently tried to get the recovery team to pay his accounting bill of $8000 to get access to the records the team paid for, long ago. Here’s an example of the kinds of “deals” Johnson tries to make behind the scenes with his investors: The GGC team was to pay the accountant, in full, and in return would receive an income statement and balance sheet. The full accounting detail of all transactions would then be sent to Johnson and denied to the recovery team!

Well, the GGC team did not take the “deal” as they had already gathered the documents and conducted their own painstaking forensic accounting of what has transpired. As outrageous as the “deal” offered to the team was, an important thing to note is that Johnson doesn’t even have a copy of his own books!

Johnson’s Law

The cost of filing a completed criminal complaint in Chile is ~$50,000 US. Johnson somehow managed to get one filed and But, Johnson has not filed anything with the Chilean courts, recently. The complaint he showed up with at the GGC gates on April 20th, with two policemen in tow, was likely a prop drawn up by a lawyer (Johnson doesn’t speak Spanish).

Johnson’s “complaint” was that the farm workers were selling off his property to pay farm worker salaries and pensions. One must understand that Johnson’s priorities leave the payment of expenses such as farm worker salaries downstream of just about everything.

Cobin made a comment on a podcast in early 2014 wondering when Johnson would run out of lawyers willing to work for him as Johnson seems to have trouble paying his legal and accounting bills. That could mean his current lawyer either won’t be around for long or is expecting a form of compensation other than money.

Johnson is Probably Furious and Broke

If Johnson is the psychopath he’s widely speculated to be such predators are infuriated by exposure of their crimes and schemes. They become physically ill upon losing control to their “Inferiors” (Everyone other than themselves). One theory is that Johnson was so infuriated when the recovery team took over physical control of the property, last October, that he couldn’t stand himself until he took it back. As trivial and adolescent as this may seem to an outside observer such motivations are quite real and possible to a psychopath.

Johnson presents as positive for most items of Dr. Robert Hare’s psychopathy checklist. As such, it’s not irresponsible to use the metaphor that we are all mere projections in the twisted video game Johnson sees through his eyes that he calls his life. There’s a certain threshold of destruction and pain that can only be inflicted by those incapable of feeling empathy for their fellow man and many of those directly involved with GGC believe Johnson is there.

Ironically, Johnson’s occupation of the land is of minor importance to the recovery team. It may even give the team the ability to retain the moral high ground while letting Johnson pay “his own” bills, for a change. Any money that johnson uses to pay a bill would have come from the investors, anyway. In that sense, any bills he pays might be viewed as a form of recovery.

Johnson, like socialism, may also be running short of other people’s money, about now, and need a place to stay. Since he used investor money to pay for the property they should send him an invoice for the rent he’s now accruing by occupying the property and blocking such income to investors. His rental rate could be set at the same rates he quoted for a per-night stay at the hacienda in the sales brochures ($150 per night). Every month Johnson occupies GGC would incur rent due of $4,500 US.

Water Rights?

Johnson may have something up his sleeve in attempting to sell-off (Again) the most valuable asset of the GGC land: Water rights. Although the injunction, which blocks any sale until all legal actions against the property are resolved, is still in place, Johnson’s current lawyer has experience in the area of water rights. It’s not outside of the realm of possibility that Johnson has worked a deal with the lawyer to do this. The criminal complaint Johnson filed, that enabled him to show up at the gates with two policeman, can cost as much as $50k US to perfect. Johnson may have worked some backroom deal with the lawyer to work, pro-bono, with the promise of a share of future water rights. This is mere speculation on my part, but possible, considering what is of remaining value of El Lepe outside of free rent for Johnson.

Johnson Surfaces to Contact Wendy McElroy

Johnson “surfaced” in March to contact libertarian writer, Wendy McElroy, who purchased an option on a GGC parcel with her husband, Brad. Though Wendy is no fan of Johnson she thought perhaps talking with Johnson would facilitate some progress in negotiations without further involvement of State entities. For Johnson’s part, he’s received nothing but the bad press he deserves since Wendy’s exposé, last year. Perhaps Johnson thought he might turn that around if he could be seen as reasonable to a talented writer and GGC option owner. McElroy broached the possibility of further exchanges with Johnson to investors and I have no information about how it might have been received or if any progress was made.

No doubt Wendy’s exposé saved some number of potential new investors from losing money in GGC. She was not, however, responsible for the drop-off in GGC sales, as previously speculated. A forensic accounting of sales receipts shows a precipitous drop-off of investment money in January 2014 after Berwick stopped marketing GGC in October of 2013. So, after deals already in the pipeline were closed … sales slowed to a trickle. As described in Part 4 of this series, Berwick’s marketing efforts were the prime mover in bringing investor money into GGC. When Berwick stopped marketing, people stopped investing. Wendy’s articles exposed the reasons why Berwick stopped marketing but she did not cause him to stop. Berwick followed up the next day with an article of his own confirming Wendy’s information and adding his own take on the state of GGC and why he stopped marketing efforts.

Farm Status

The lemon trees need 50 Liters per second (LPS) to thrive and are now only receiving 1.5 LPS. Receiving so little water will greatly stress the trees and is a bad indictor for next years harvest.

The office and Hacienda were in great shape prior to Johnson’s reoccupation with pictures to prove it. In fact, it might have been about time to start renting it out for supplemental income to support the farm. Now that Johnson’s on site and blocking access to the investors, again, Johnson will most likely let the property fall back into decay. For all of Johnson’s lies the place was approaching biohazard status as the recovery team came on site, in October. We can only hope that Johnson’s hyped “Animal sanctuary” has also lost it’s credibility and more dogs won’t be dropped off to starve to death while Johnson feeds salmon filet’s to his own dog.

Litigation Pending

There are two civil suits pending from investors:

- Josh Kirley’s suit which questions the procedures with which “El Lepe” was purchased from Ramirez, by Johnson. The Chileans are meticulous in their paperwork and Johnson showed the wrong ID for the deed of purchase. However, he did show the correct ID (Passport) in the closing. This civil case has already been heard and is awaiting a decision.

- Jerry Folta’s civil suit, filed on 4/2/15, on behalf of Jerry’s entity (Jumpin’ G SpA) against Johnson’s entity, Inmobiliaria Galt’s Gulch S.A., for $450,000. Folta paid $450,000 US for the purchase of a 25 acre lemon orchard lot. It appears to me that Folta’s suit is positioned to become an uncontested judgement that will be turned into a lien against Johnson’s entity. Such a lien would put Folta in line before other investors should the company that holds the property be sold. Should Kirley’s suit start fraudulent sales to unravel Folta’s at the front of the line to block the sale or be paid off first.

I should mention that Johnson’s suit filed against Mario Del Real is about the theft of already stolen property. The first theft was performed by Johnson as he took investor money and used it to take ownership of the land in the name of his own personal entity and not the entity formed by Cobin, Eyzaguirre and Berwick with which receipt was to be taken. Therefore, Johnson’s suit against Real involves the dispute between thieves of previously stolen property.

Civil lawsuits are not issued a date to be heard in Chile. This is Chilean style justice and cases are heard as the judge gets to them or sees fit. The general public does not know when a case “is about to be heard”, despite Johnson’s public warnings.

Folta’s Follies

Jerry Folta has been playing both sides against the middle since GGC started unraveling. He pretends to support Johnson while filing civil suits against him. When questioned, he says the other investors don’t understand what’s going on and that he’s not suing Johnson. Technically, it’s Jerry’s entity (Jumpin’ G SpA) filing against Johnson’s entity (Inmobiliaria Galt’s Gulch SA). Is that what investors don’t understand? That the civil suit is filed between entities and not people? If so, Folta’s playing word games with the investors. Folta’s contracts are convoluted, as well, with all sorts of meandering language and terms.

If Folta still supports Johnson and yet files such lawsuits against him, then they’re both playing games such as what I’ve described as a lien disguised as a civil suit. What normal business relationship involves sending invoices to each other in the form of civil lawsuits? Perhaps a relationship in cahoots to use any form of fiat they want to make things go their way: Fiat loans, invoices, liens, mortgages, and even civil lawsuits, in whatever manner they agree to use them to protect their interests. It will take more digging to unravel such alleged constructive filings, completely, and I have not done so.

Short-term Predictions

My predictions are that the same sorts of things that happened before, when Johnson was “in charge” and blocking farm access to the investors who paid for it, will happen again:

- Johnson will make no improvements, whatsoever, to the property.

- Johnson will conduct no maintenance, whatsoever, to the property.

- Johnson will string along, exploit and burn any employees or creditors who didn’t learn the folly of trusting him the last time around.

- The place will be slowly returned to biohazard status as a result of Johnson’s squatting and “living” habits.

- No bills will be paid so the electricity, and any other utilities, will be shutoff per the policies of the local Chilean energy provider.

- Johnson will spend his days trying to figure out how to sell-off anything of value he possibly can: Water rights being the crown jewel and trickling downwards from there.

- Any money Johnson receives as a result of one of his sell-off schemes will go directly into his pocket and to no one else.

- And, last but not least: Even Jerry Folta will get further burned by Johnson.

When Johnson sends public updates about GGC I’ve found the best way to glean any actual truth they may contain is to invert every assertion and work from there.