- Part 1: What Happened and When? — GGC Story, Timeline & References.

- Part 2: Root Cause of Problems? — The Creature from Galt’s Gulch.

- Part 3: How Might Problems be Avoided in the Future? — Contracts are Good for Libertarians, Too.

- Part 4: What’s the Deal with Berwick and GGC? — Jeff Berwick & GGC: A Regrettable Summary.

Last week, a GGC investor working with the Recovery Team sent me an e-mail with feedback on the four articles I’d written about the Galt’s Gulch Chile land development deal. Though I’d sent the first two articles to John Cobin and Wendy McElroy, this was the first correspondence I’d had with someone directly involved with the deal. The first four articles were written from what could be gleaned from all public documents, radio shows, forums, facebook, articles and their comment sections. Part 5 brings the series current with new information and feedback from those involved. My hope is that such provides a bridge to future articles that may be of more direct assistance to real-time recovery efforts. To that end, this will be the last article that refers to Cobin/Ezyaguirre, in any significant way, as their initiating role has already been addressed and they were cut out of the deal early in the development.

As you read the exchange (And any article in the series) keep in mind that the actions of those involved are either good, fine, questionable, wrong, or illegal. Much of the last three categories can only be decided, in retrospect. The legalities depend on “the law” of one’s vantage point: Natural, Chilean or US. My opinion is that most all of Johnson’s actions were wrong from the standpoint of natural law as I see nothing indicating he ever intended to keep his promises to those involved. The Recovery Team would prefer to remain diligent and prudent in refraining from making legal judgements without supporting evidence.

Recovery Team: Part I: It is not clear that the project had enough water for the development as Cobin advertised. As you know, it’s a dry climate, and scope of the project was large. However, another huge problem was that it is all environmentally protected. I have been told that the gov’t will allow only 12 parcels to be carved out of it.

Terence: Yes, Cobin’s water estimates could only be realized if all the wells were cleared, consolidated and inscribed to the property. Cobin said he and Eyzaguirre could do it (Restated by Cobin on his radio show during Berwick’s apology episode) and such was to be a crucial part of their contribution to the deal. Everything I’ve read indicates Johnson and Berwick cut ties with Cobin before the property was purchased. Johnson’s accusations against Cobin, or anyone else, for that matter, hold no weight because of Johnson’s clear pattern of accusing others of his own failures.

I hadn’t read that environmental concerns were tied in with the inability to zone the land, properly. If so, overcoming this obstacle would be as crucial to the project as consolidating the water rights.

Recovery Team: Also, I think you said–or maybe implied–that Cobin/Eyzaguirre somehow put money into the project. Other than pocket money, maybe, you are mistaken.

Terence: I see Cobin’s contribution as significant but non-monetary. He had the vision, chose the location and got the project rolling by involving Berwick to attract capital. This is what enabled Berwick and Johnson, neither of whom had stepped foot in Chile prior to flying down to meet Cobin, to connect with a large development deal within hours of their arrival.

Recovery Team: I doubt that Del Real and Johnson lived together. At one point early in their business (if you could call it that) relationship, Del Real bought office furniture, put it at the farm office and he and his daughter were working there. I’ll double check on that.

Terence: Berwick made this comment when talking with Cobin on his radio show. Since Johnson’s “sale” of GGC stock to M. Del Real and his daughter, Pamela, is important to the recovery, perhaps their living and working arrangements are worth knowing about.

Recovery Team: You imply throughout that Cobin/Eyzaguirre were necessary to the success of the project, but I doubt it. I have not met either person, but I have heard Cobin on the internet and have seen his astronomical consulting fees. Why Berwick/Johnson would agree to the equivalent of a finders fee of 25% for that property that can’t be developed is beyond me. Further, see attached the ridiculous marketing material that Cobin spearheaded. This wreaks of scam–$1M revenue per year for fish? Selling electricity? Selling water??? Too bad they didn’t continue on this vein, I would have been spared my losses since I wouldn’t touch the project with a ten foot pole with Cobin and his spin involved.

I am sure that had Johnson not been Johnson, he would have been able to find someone in Chile to develop the project. Cobin/Eyzaguirre were never necessary.

Terence: It appears Johnson did only enough “work” to muddy the waters for his cons and overpriced Chilean side-deals. Cobin/Berwick say the finders fee and GGC sales percentage was based on Cobin finding the land, creating the deal, negotiating the price of the first property, El Penon, to be $270/acre, and consolidating and inscribing the water rights. However, what Berwick and Cobin promised each other is between them. Nothing I’ve seen ties Berwick’s promise to Cobin to the GGC investors who probably never set eyes on Cobin’s business plan. Aside from his optimistic estimates the significant part of the document, for me, is that it shows that Cobin was fooled by Johnson’s persona, as well. It also shows that he had no idea that Berwick and Johnson would shortly cut him completely out of the deal.

Recovery Team: Part IV: Johnson lived off us for 2 years, not 3–from sept 2012 to sep 2014.

Terence: Very glad to hear that! I’ll update the article.

Recovery Team: The biggest hole in your articles is that you don’t even touch on the real story. This is NOT a purely gringo on gringo scam. Johnson could not have done what he did were it not for willing accomplices in Chile. There is a string of crooked notaries and lawyers enabling his illegal activities. Further, the Chileans, being good scammers themselves, sniffed Johnson out and then scammed him. Our problems now are that the overt scam artist, Mario Del Real, took control of the company and will not give it back, and that the seller, Guillermo Ramirez, appears to have 1. gouged Johnson on the price of the property, 2. misrepresented the water situation, and 3. may have been in partnership with Johnson in running up huge late fees. Johnson was never able to pay any but the first payment on the land on time. One document I have says that $1.14M in late fees were paid.

Terence: Wow! I stayed out of all the swaps (Sales?) and side-deals referred to in the “Kerfuffle” document to focus on the overall story and the gringos, first. I certainly understand that, from the GGC investors point of view, these are the most important aspects of the current recovery.

Recovery Team: Further, the whole time that one would think that Johnson would be very busy with obtaining the proper permits, managing the development and farm, as well as overseeing marketing and sales, he was looking for other “great deals” in Chile. That’s how he was scammed with the Rio Colorado deal. He also pursued buying water in Patagonia (?), and various bitcoin projects–he stole $100k from one of our investors with a bitcoin deal. He even put bids on a neighboring property and tried to negotiate a sort of lease-option arrangement with other neighbors. To the bitter end, he was sending emails telling us about how he was going to build a large solar greenhouse. Yet during all that time, the permits to subdivide the property were getting nowhere, the farm was deteriorating, and employees and vendors were being stiffed.

No vat tax was ever paid by Johnson for the sale of the lemons harvested and sold on the property. Last week, we finally had a visit from SII. Why couldn’t they have shown up when Johnson was stiffing them?

Terence: Whew! What a tangled mess. How intriguing that Johnson, himself, might have been scammed while he was using GGC investor money to protect himself from GGC investors. Unfortunately, lying to the bitter end is another characteristic of psychopathic behavior. For those who haven’t yet watched the documentary, “I, Psychopath” it’s worth the time:

I noticed Mario Del Real is described as having previously worked for the Chilean IRS (SII). Perhaps there’s a connection between his expertise and the timing of SII’s visit? Either way, bad timing all around.

Recovery Team: I have a descriptive timeline I’ve been working on. It definitely needs more work, but I’m supplying documents with nearly every entry. I’m also working on a financial timeline with documentation. I’m waiting for more accounting information to finish these.

Terence: I can’t think of anything more important to recovery efforts than such a timeline and the documents that go along with it. I’ll update the timeline in Part one with anything you can pass along.

Recovery Team: Btw, Jerry Foltas posts on the GGC webpage are not correct. I’ve caught him several times in contradictions. His only response to me is that I’m not reliable. yeah, right. I provide documents for everything I say, and I am trying to be especially careful to make no accusations. I try simply to present the documents and let them speak for themselves.

Terence: As an outside reader I can barely get through Folta’s “Newsletters”. I thought him a Johnson created sock-puppet prior to reading that the team had met with an actual person of the same name outside the GGC office. While reading Jerry’s “Newsletters” my theory was that he had taken advantage of the absence of a shareholders agreement (Which would have given a Right of First Refusal of IGGSA shares to all investors) and coaxed GGC shares out of Johnson in order to gain control of GGC. This would be “playing both sides against the middle”. A more tragic reality for Folta would be if, having lost his initial investment, Johnson scammed him again and Folta lost more money in return for GGC shares that were not Johnson’s to sell.

Where’s the Libertarian Media?

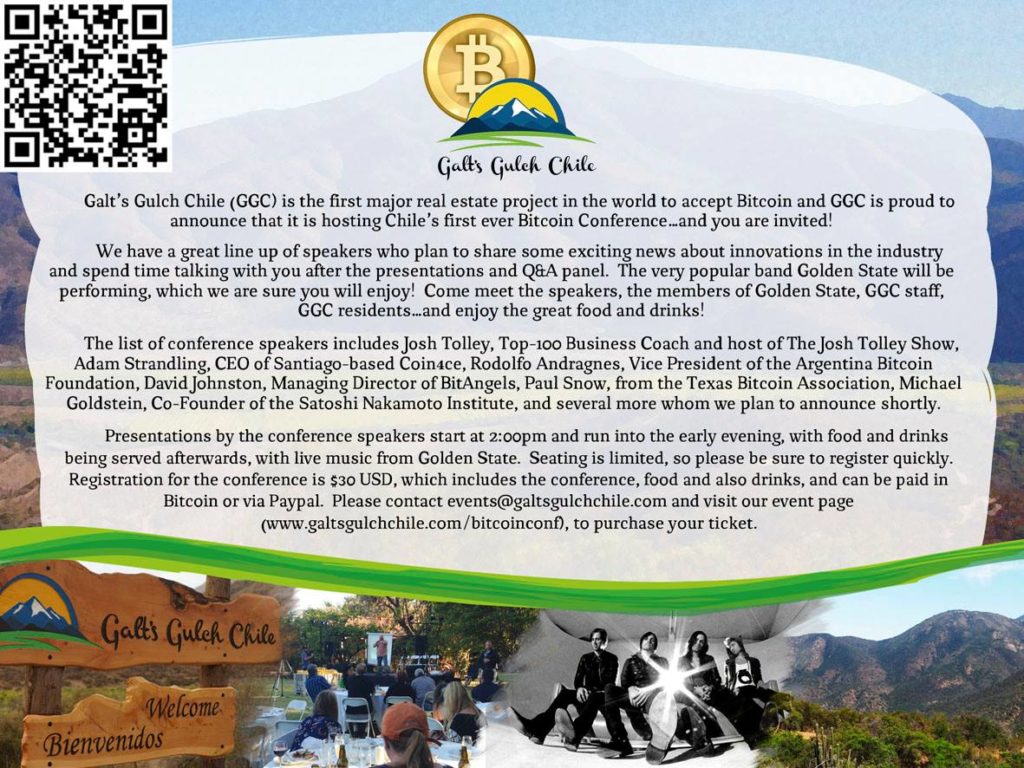

What’s with the absence of Libertarian commentary on Galt’s Gulch Chile? Even the Libertarians that spoke at the GGC Fall or Spring event held on GGC grounds in Chile seem to have little to nothing to say. The Recovery Team knows that the attendance of these libertarians was never an endorsement and that they had no access to information that would enable them to vett or endorse the project. It would be nice, however, to hear more from Ben Swann, John Tolley, Bob Murphy, Luke Rudowski, and others that actually set foot on the grounds.

Note: All articles on McGillespie.Com may be reposted in full, or in part, per Creative Commons license “By” and “Share-alike”.

Regarding Investors

I didn’t say much about the Founders or the investors in my first four articles because I didn’t know anything about them. As of today I do know this: The Founders had no idea what Johnson was doing. It’s beginning to appear that Johnson used Founder money to hire lawyers to protect himself against the Founders, themselves. They were confused with Berwick’s incompetence, and Johnson’s series of thefts and counter accusations, until mid-2014. They probably thought disagreements between Berwick and Johnson were that of typical partners, each with 50% ownership but neither with majority control. In fact, even today, it’s a tough forensic task to piece together the timeline and documents Johnson withheld from investors to the end.

Prior to his investment, Josh Kirley (One of the first investors) hired a Chilean law firm and offered them an additional bonus, above and beyond their hourly rate, if they could come up with any reason to not move forward with his investment into GGC. When they came up with nothing Kirley followed up with a background check of Johnson and still, no red flags appeared. Onlookers may protest that any number of items on some personal due diligence list were not covered but Kirley’s first two efforts at protecting his investment were quite bold. Contrary to popular understanding, lawyers are trained to find fault with, not enable, contracts and deals. And yet, they came up with nothing.

I’d also point out that the sophistication level of those who were fooled by Johnson’s psychopathic behavior is rising with every stone of this story unturned. Cobin’s business plan even documented Johnson’s many possible contributions to GGC as if they were additional selling points of GGC. It would be a mistake, therefore, for readers to believe that such behavior will be obvious should it be encountered, personally.

What’s Next?

The money and ownership trail of GGC has been greatly muddied and confused by Johnson’s complex maze of stock swaps (Sales?), director appointments, multiple bank accounts, additional overpriced purchases, missed payments, secondary entities, bitcoin theft, and suspicious penalty clauses, etc. These are the sorts of things Johnson was “working on” while claiming to investors that he was busy developing GGC. Even today, the investors are attempting to piece together the basic financial statements and reports that Johnson had been denying them for so long. The documents they’re discovering reveal a maze of deceit rather than land development.

Money invested into GGC was always about purchasing land. There are still many reasons to hope that, if investors can’t recover money, they might recover land. It wouldn’t be a total restoration but it would restore control of what was always at the heart of the deal.

It took four articles to tell the story of what happened, why and what others may do to avoid problems like this in the future. I didn’t follow the maze of Johnson’s deals (Likely made possible by Chilean collusion) as it wasn’t relevant to those purposes. However, it most certainly is relevant to efforts to recover money or control over the land. If I can make a contribution in that area, I will. The focus now is on substantiating Johnson’s activities and the gaggle of Chilean swindlers that may have followed in his wake.

I’ll conclude Part 5 with an open message to Jeff Berwick: I’ve run across the name of the investor Berwick referred to as left homeless having lost everything on his investment into GGC. This investor is, indeed, in dire straits. If Berwick is ready to keep the promise he made on the Freedom Feens Radio Show then now (1/28/15) would be an ideal time for him to help this investor. I’m sure someone on the Recovery Team would be happy to pass along his current location. Contact them at ggc.pressrelease@gmail.com.